ABUJA — The Nigerian Bar Association (NBA) has called for an immediate suspension of the Tax Reform Acts, citing alleged discrepancies between the gazetted versions and the bills passed by the National Assembly.

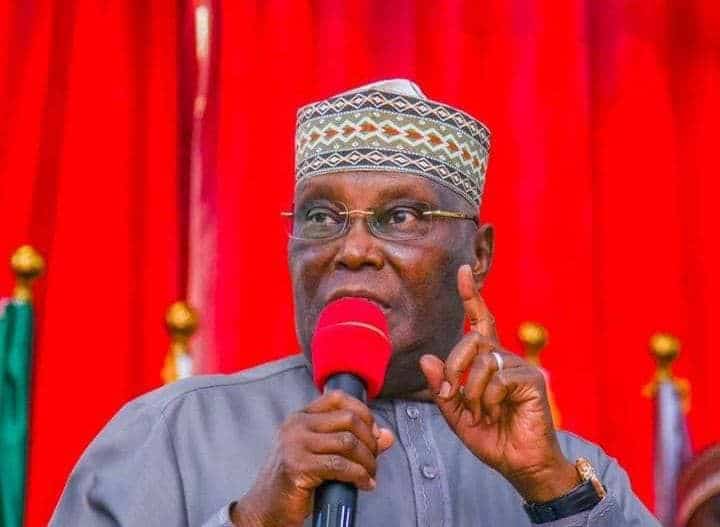

Former Vice-President Atiku Abubakar also urged the Federal Government to halt the implementation of the new tax laws, describing the alleged post-passage alterations as “illegal and unauthorised,” and called on the Economic and Financial Crimes Commission (EFCC) to investigate.

Abubakar condemned the changes as “a brazen act of treason against the Nigerian people and a direct assault on our constitutional democracy,” accusing the executive of overstepping its mandate in ways that prioritize revenue collection over citizens’ welfare.

Despite the controversy, both chambers of the National Assembly adjourned for the Christmas and New Year break, scheduled to end on January 27, 2026, without addressing the allegations. However, lawmakers approved the repeal and re-enactment of the 2024 and 2025 budgets, with N43.561 trillion and N48.316 trillion approved respectively, and extended the 2025 budget implementation to March 31, 2026. The N58 trillion 2026 Appropriation Bill passed second reading in the Senate.

Last week, House member Abdulsamad Dasuki highlighted discrepancies between the bills passed by the National Assembly and the gazetted versions. The NBA, through its president Afam Osigwe, called for a “comprehensive, open, and transparent investigation” and insisted that implementation of the Tax Reform Acts be suspended until the matter is resolved.

The NBA warned that the controversy could have serious economic consequences, creating legal and policy uncertainty that threatens investor confidence and disrupts the business environment.

President Bola Tinubu had signed the four tax reform bills in June 2025, including the Nigeria Tax Bill, the Nigeria Tax Administration Bill, the Nigeria Revenue Service (Establishment) Bill, and the Joint Revenue Board (Establishment) Bill, with implementation slated for January 1, 2026. Opposition leaders and groups, such as Peter Obi of the Labour Party and the African Democratic Party (ADC), have demanded a halt to the implementation.

Chairman of the Presidential Fiscal Policy and Tax Reforms Committee, Taiwo Oyedele, defended the reforms, stating that they aim to simplify tax compliance, eliminate burdensome taxes, and boost domestic productivity.

Senate Revises 2024, 2025 Budgets

The Senate approved revised budgets for 2024 and 2025, increasing the 2024 Appropriation Act from N35.005 trillion to N43.561 trillion, and reducing the 2025 figure from N54.99 trillion to N48.316 trillion. Adjustments included rolling over part of the 2025 capital expenditure into 2026 and adding N8.5 trillion to the 2024 capital allocation for urgent interventions in security, humanitarian, and economic sectors.

Both bills were passed in the House of Representatives, authorizing payments from the Consolidated Revenue Fund based on ministerial warrants. Detailed statutory transfers and allocations for agencies such as the National Judicial Council, NDDC, UBEC, and the National Assembly were included.

2026 Appropriation Bill Passes Second Reading

The N58.472 trillion 2026 budget passed second reading in the Senate, with expenditure covering statutory transfers, debt service, recurrent non-debt spending, and capital expenditure. Senators pledged rigorous scrutiny to ensure transparency, fiscal discipline, and meaningful economic outcomes.

Atiku Abubakar criticized new provisions granting broad enforcement powers to tax authorities, arguing that these changes undermine due process and oversight, increase the financial burden on citizens, and reflect a government more focused on punitive taxation than on addressing poverty, unemployment, and inflation.